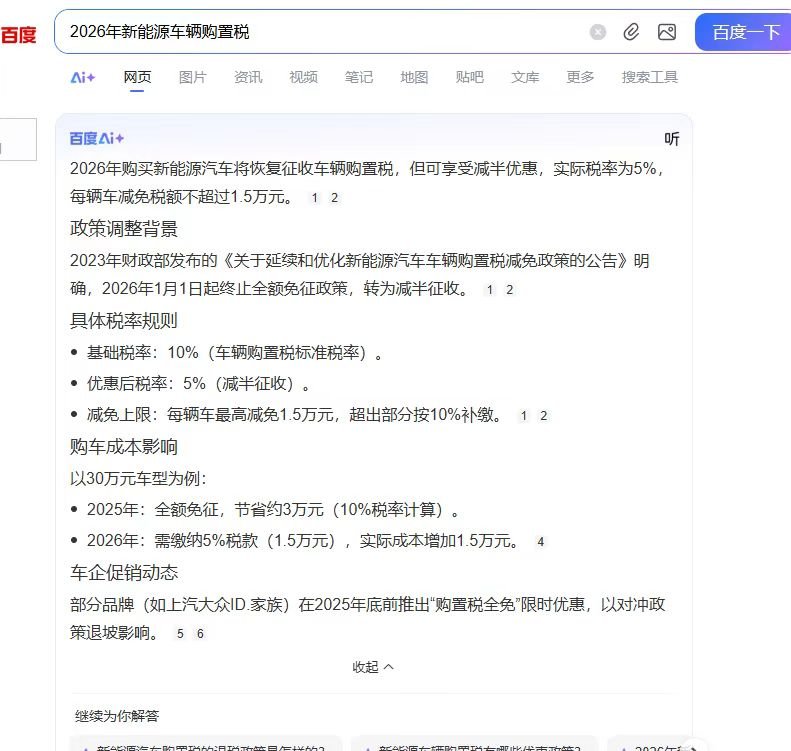

In 2026, the purchase of electric vehicles will again be subject to value-added tax, but a 50% discount will be available, with an actual rate of 5% and a maximum annual discount per vehicle not exceeding 1.5 million yuan.

Policy Adjustment Fund

The Ministry of Finance’s 2023 publication on the extension and optimization of tax exemption policies for the purchase of electric vehicles states that, starting January 1, 2026, the full exemption policy will be terminated and converted to a halved tax reduction.

Specific Tax Rules

- Base rate: 10% (standard vehicle purchase tax rate).

- Rate after discount: 5% (halved).

Line of payment already comes from a point of 15,000 yen and the price is paid with a 10% discount.

Year

Effects on Purchase Costs

Taking a value of 300,000 yuan as a starting price - 2026: Tax exemption, saving approximately 30,000 yuan (calculated at a 10% rate).

- In 2026: A 5% tax (15,000 yuan) must be paid, increasing the actual cost by 15,000 yuan.

Auto Promotions

Some brands (such as SAIC Volkswagen’s ID family) will launch a limited “full acquisition tax exemption” offer before the end of 2025 to offset the impact of the policy rollback.

Leave a Reply